Navigating roof replacement insurance coverage can be a complex process. At Harvey Roofing & Construction, we’ve seen firsthand how understanding your policy can make a significant difference in the claims process.

This guide will walk you through the common causes of roof damage covered by insurance, types of coverage available, and steps to file a claim effectively.

What Roof Damage Does Insurance Typically Cover?

Insurance coverage for roof damage can vary based on the cause and your specific policy. At Harvey Roofing & Construction, we encounter consistently encounter cases where homeowners are uncertain about their coverage. Let’s examine the most common types of roof damage that insurance typically covers.

Storm Damage: The Primary Culprit

Storm damage tops the list of reasons for insurance claims related to roofs. This includes damage from high winds, hail, and fallen trees or branches. The Insurance Information Institute reports that wind and hail damage accounted for 35.1% of all homeowners insurance claims between 2016 and 2020.

Hail stones can inflict significant damage to shingles, potentially causing leaks and further interior damage. Wind can lift and remove shingles, exposing your roof’s underlayment. Fallen trees or large branches can cause severe structural damage, necessitating immediate repairs or even full replacement.

Fire and Smoke Damage

While less frequent, fire damage usually falls under standard homeowners insurance policies. This covers damage from both external fires (such as wildfires) and internal fires that spread to the roof. Smoke damage, which can be less obvious but equally harmful, also typically receives coverage.

Sudden Water Damage

Insurance often covers water damage resulting from sudden, accidental events. This might include a tree falling and creating a hole in your roof during a storm, allowing water to enter. However, gradual water damage due to lack of maintenance typically doesn’t receive coverage.

Weight of Ice and Snow

In colder climates, the weight of accumulated ice and snow can cause roof collapse or other structural damage. Most standard policies cover this type of damage, but it occurs less frequently in warmer areas like Texas (where Harvey Roofing & Construction operates).

Insurance generally doesn’t cover normal wear and tear or damage resulting from lack of maintenance. Regular roof inspections and maintenance can help prevent these issues and extend your roof’s lifespan.

If you’re unsure about your coverage or need a professional assessment of roof damage, contact a reputable roofing contractor. They can help you understand the extent of the damage and guide you through the insurance claim process if necessary.

Now that we’ve covered what insurance typically covers, let’s explore the different types of insurance coverage available for roof replacement.

Types of Insurance Coverage for Roof Replacement

Understanding your insurance coverage is crucial when it comes to roof replacement. Different types of coverage can significantly impact your out-of-pocket expenses for repairs or replacement. Let’s explore the main types of insurance coverage for roof replacement.

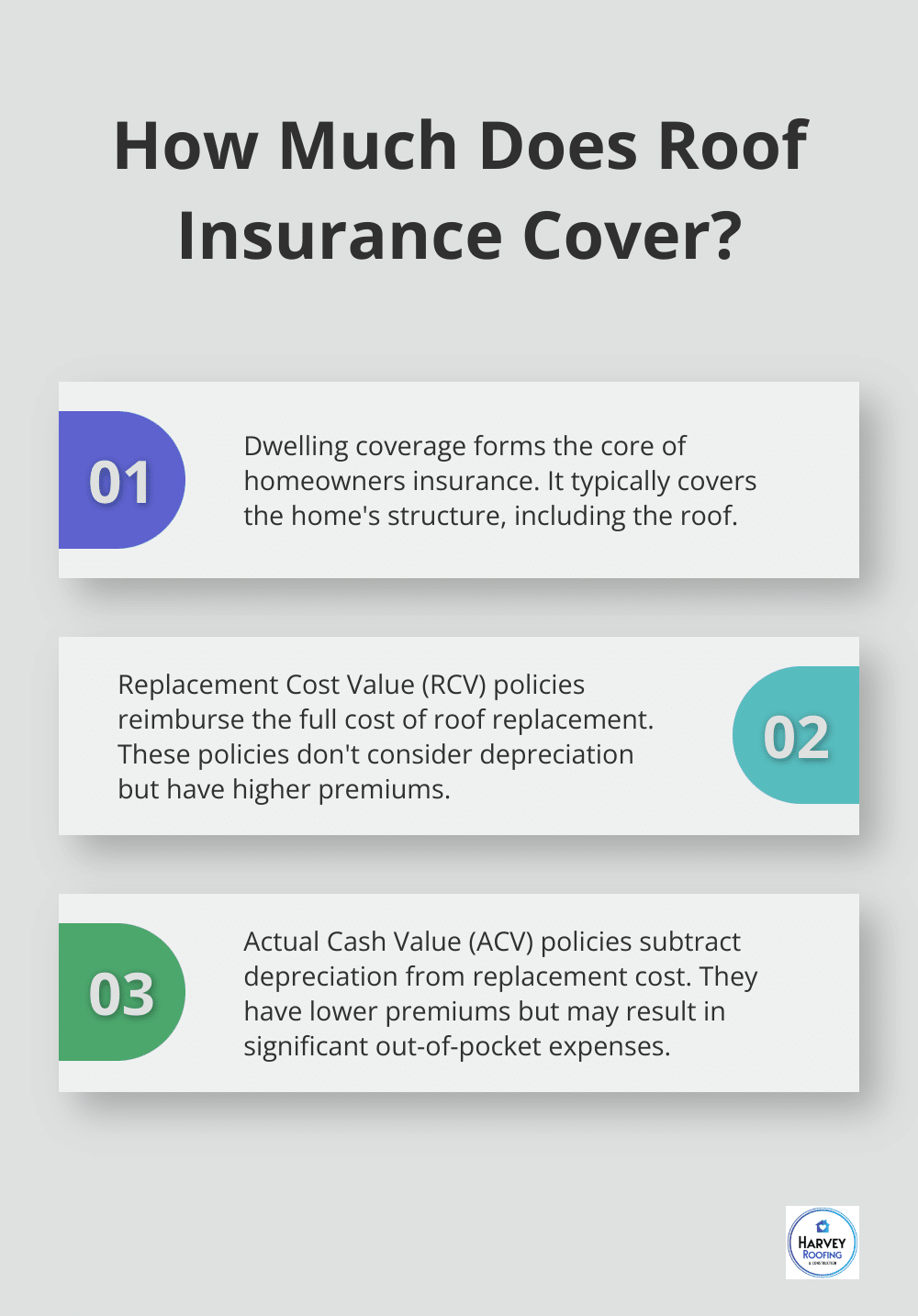

Dwelling Coverage: The Core of Your Policy

Dwelling coverage forms the foundation of your homeowners insurance policy. It typically covers the structure of your home, including your roof. The amount of dwelling coverage should suffice to rebuild your entire home if necessary.

Replacement Cost Value (RCV): Full Reimbursement

RCV policies often represent the gold standard for roof insurance. These policies reimburse you for the full cost of replacing your roof with materials of similar quality, without considering depreciation. While RCV policies generally have higher premiums, they provide more comprehensive coverage.

Actual Cash Value (ACV): Depreciation Considered

ACV policies take into account the age and condition of your roof when determining payout. These policies subtract depreciation from the replacement cost, which means you’ll likely receive less money for an older roof. While ACV policies typically have lower premiums, they may result in significant out-of-pocket expenses for roof replacement.

Extended Replacement Cost: Additional Protection

Some insurers offer extended replacement cost coverage as an add-on to your policy. This type of coverage provides an additional percentage (usually 10-50%) above your dwelling coverage limit. It can prove particularly valuable in areas prone to natural disasters, where rebuilding costs may suddenly increase due to heightened demand for materials and labor.

When selecting your insurance coverage, consider factors like your roof’s age, your area’s climate, and your financial situation. If you’re uncertain about your current coverage or need help interpreting your policy, consult with your insurance agent or a reputable roofing contractor. They can help you navigate the complexities of roof insurance and ensure you have adequate protection.

Now that we’ve covered the types of insurance coverage, let’s move on to the steps you should take when filing a roof replacement insurance claim.

How to File a Roof Replacement Insurance Claim

Document the Damage

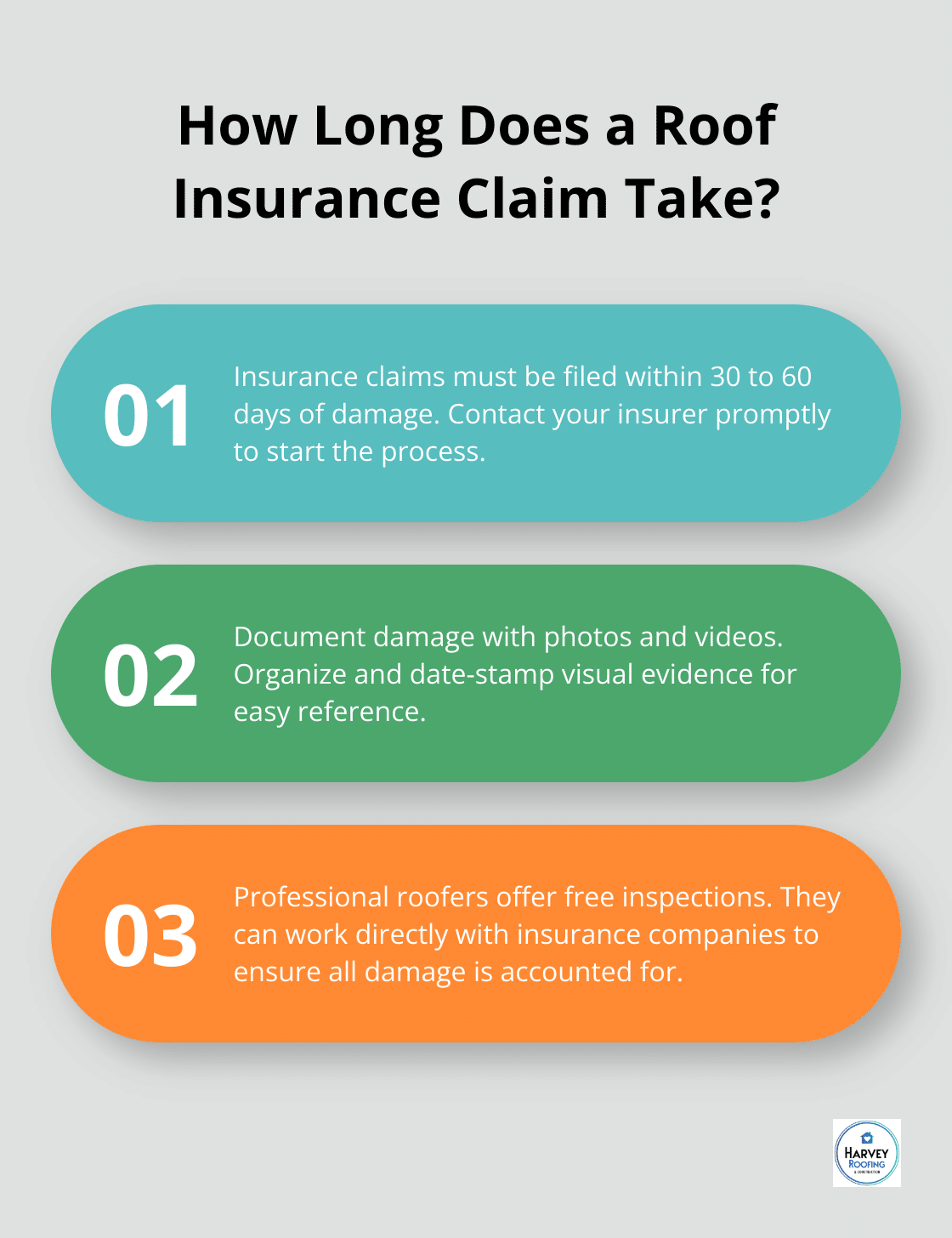

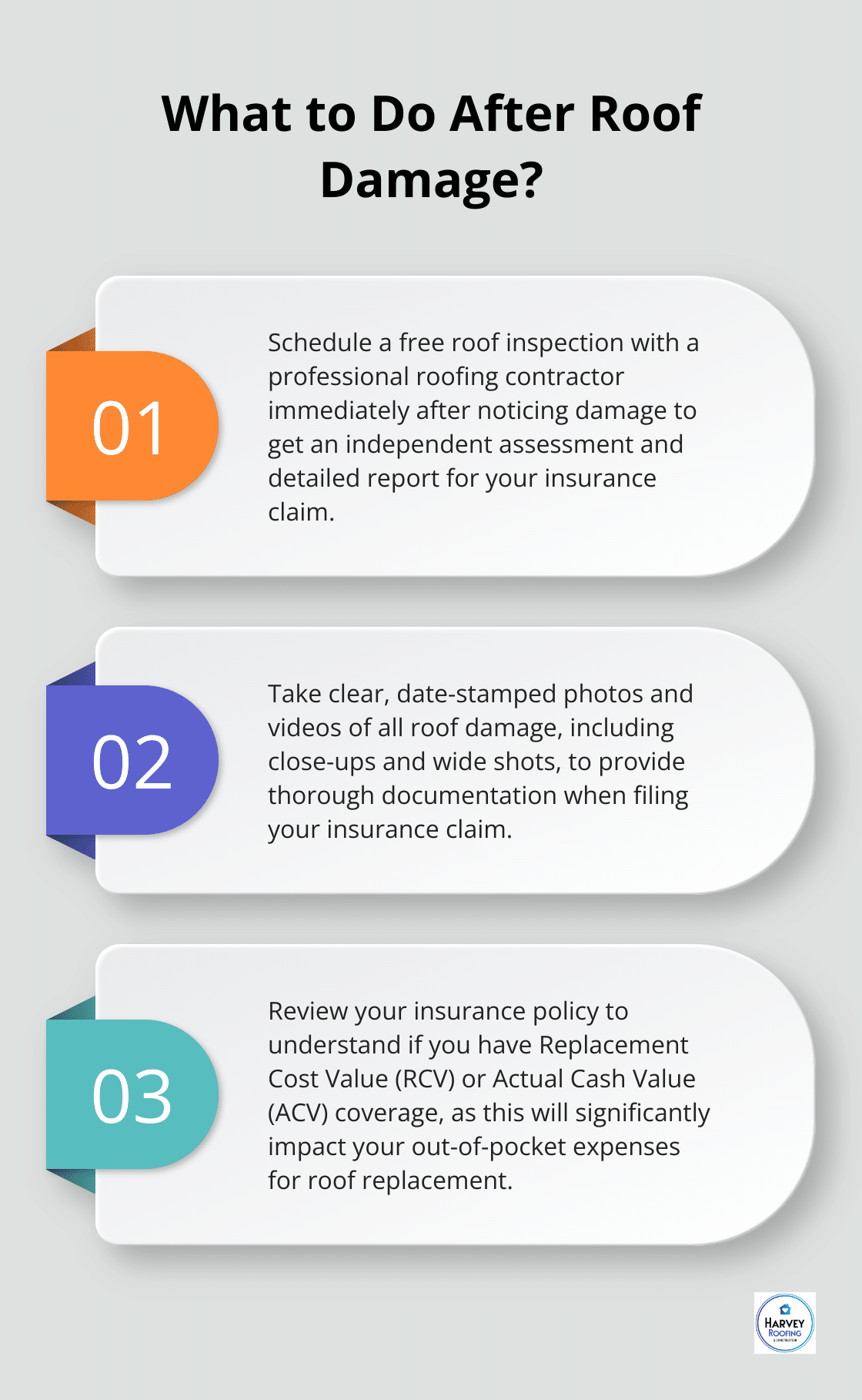

The first step in filing a successful claim is thorough documentation. Take photos and videos of your roof as soon as you notice damage. Capture close-ups of damaged areas and wide shots that show the overall condition of your roof. If possible, photograph the ground around your home, especially if there’s evidence of hail or fallen debris.

Date-stamp your photos and organize them for easy reference.

Contact Your Insurance Company Promptly

Time matters when it comes to roof damage. Most insurance policies have a specific timeframe for reporting damage (typically 30 to 60 days). Contact your insurance company as soon as possible to report the damage and start the claims process. Provide basic information about the damage and when it occurred. Your insurer will assign you a claim number and schedule an inspection with an adjuster.

Schedule a Professional Assessment

While the insurance adjuster will conduct their own inspection, get an independent assessment from a professional roofing contractor. They can provide a detailed report of the damage and an estimate for repairs or replacement.

Many reputable roofing companies (including Harvey Roofing & Construction) offer free roof inspections and can work directly with your insurance company to ensure all damage is properly documented and accounted for.

Review the Claim Estimate

Once the inspections are complete, your insurance company will provide a claim estimate. Review this carefully, comparing it with the assessment from your roofing contractor. If there are discrepancies, ask questions or request a re-evaluation.

Understanding your policy’s coverage details is important at this stage. Know whether you have Replacement Cost Value (RCV) or Actual Cash Value (ACV) coverage, as this will significantly impact your out-of-pocket expenses.

Work with Experienced Professionals

The claims process can be complex, but you don’t have to navigate it alone. Professional roofing contractors experienced in insurance claims can be a valuable resource. They can help you understand the process and ensure you receive fair compensation for your roof damage.

Try to choose a contractor (like Harvey Roofing & Construction) who has experience working with insurance companies and can guide you through the entire process, from initial inspection to final installation.

Final Thoughts

Understanding roof replacement insurance coverage protects your home and finances. You must review your policy details and ask questions if anything remains unclear. Insurance coverage varies significantly, especially related to roof damage, so take the time to familiarize yourself with your specific policy.

Experienced roofing contractors make a substantial difference when you navigate insurance claims. At Harvey Roofing & Construction, we have handled many roof replacement insurance coverage cases. Our team can guide you through the entire process, from initial damage assessment to final installation. Visit our website to learn more about how we can assist you with your roofing needs and insurance claims.

Regular roof maintenance prevents future damage and extends its lifespan. You should inspect your roof (especially after severe weather events), keep gutters clean, trim overhanging branches, and address minor repairs promptly. These actions can save you from costly roof repairs and insurance headaches in the future.

Harvey Roofing & Construction

817-422-4847

www.HarveyRoofingTX.com

5712 Regalview Dr

Joshua, TX 76058